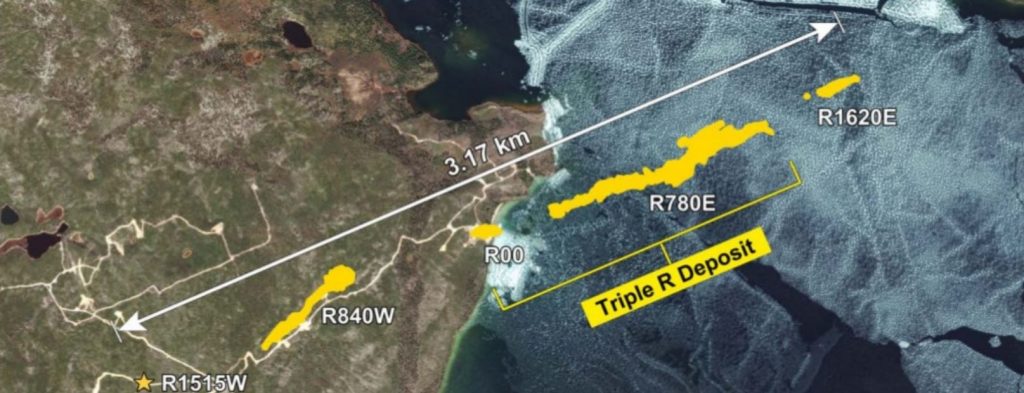

An April 2019 pre-feasibility study estimated the project's after-tax net present value at C$693 million, discounted at 8%, with an internal rate of return of 21%. The Patterson Lake South project, also known as Triple R or PLS, is one of the world's higher-grade undeveloped uranium deposits. "But unfortunately it was similar to this, where we would have to pay money each year and the rates weren't much different," Randhawa said. There was a proposal from a private investor and a possible streaming-royalty deal, he said. Randhawa said Fission Uranium considered two funding alternatives but neither was better than Sprott's debt deal. Uranium prices for immediate delivery as assessed by S&P Global Platts were US$29.95/lb as of April 8, up from US$24.52/lb on March 9.Ĭameco has repeatedly stated it does not want to reboot supply unless it can fetch a uranium price of more than US$40/lb. Uranium prices have picked up in a sign that some analysts see as an indication of stronger markets for uranium companies. In recent weeks, uranium mine supply has been under more pressure as companies pull back on production due to the coronavirus pandemic.

buying uranium on the spot market to fulfill some of its long-term contracts. Uranium producers have idled capacity due to the low price environment, with key miner Cameco Corp. Spot uranium prices have traded in the range of US$20 per pound to US$30/lb in recent years, far off highs from a decade earlier. If markets turn around and investor sentiment improves, Fission Uranium could repay debt with an equity raise, he said. Randhawa described the debt deal as giving Fission Uranium time to wait for higher uranium prices. READ MORE: Sign up for our weekly coronavirus newsletter here, and read our latest coverage on the crisis here. As part of the deal Fission Uranium also issued 20,666,667 warrants with an exercise price equivalent to 17 Canadian cents. The US$10 million secured debt facility has a four-year term and an interest rate of 10%, which is partly payable in shares. His response to the question was, "Hey, give me a term sheet." "People will say, 'Wow, why they raise money before?'" Randhawa said. He said Fission Uranium, which as a development company does not have revenues, considered other funding sources but there was no appetite among potential investors for a US$10 million equity financing. Randhawa was responding to criticism he saw on social media where people complained Fission Uranium should have raised money earlier and avoided debt.

"If there was a magic money tree out there let me know about it because I'd love to get it," Randhawa said in an interview. Fission Uranium Corp.'s Chairman and CEO Dev Randhawa pushed back against critics of the company's decision to tap US$10 million in senior secured debt from Sprott Resource Lending II to help fund development of the Patterson Lake South uranium project in Canada, saying there were no better financing options.

0 kommentar(er)

0 kommentar(er)